Our Approach

We take a four-pronged approach to investing in companies and filling gaps in the market: catalytic capital, project expertise, local partnership, and investor mobilization.

HOW WE INVEST

Catalytic Capital

With funding from our philanthropic and government partners, Elemental can invest where traditional capital markets won’t. We provide flexible funding to help entrepreneurs overcome early project risks, preparing climate technologies for commercial deployment and traditional investors.

100x

We have invested $105M directly into companies, catalyzing $11.5B in additional funding. For every dollar invested by Elemental, our companies unlock 100x.

In 2024, we created and tested a new financial product with catalytic properties that would help companies address the scale gap. The Development SAFE (D-SAFE) is an innovative funding mechanism designed to streamline development funding for projects.

Learn how our initial and D-SAFE investments in Fervo Energy—and our four-pronged approach—amplified the impact of their Cape Station project in Utah.

HOW WE DEPLOY

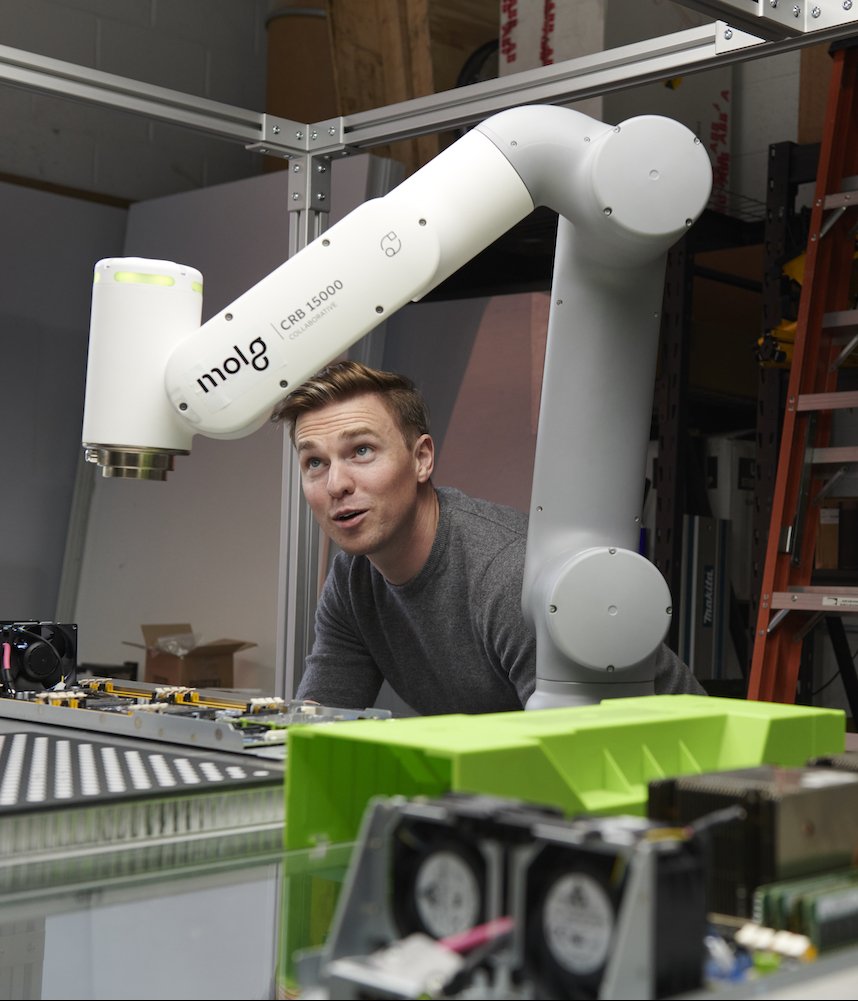

Project Expertise

Financing and building a facility requires different expertise than inventing a product or solution. We guide entrepreneurs through the complexities of commercial-scale projects, providing critical expertise in construction, financing, deployment strategies, and more.

2,000+

coaching hours delivered in 2024 focused on:

Capital stack formation

Communications and events

Policy and regulation

Project deployment

Workforce and local engagement

We invested in Capture6’s Series A and supported their ribbon cutting for their Palmdale, CA project to deploy their fresh water production and carbon removal solutions.

HOW WE IMPACT

Local Partnership

Technology deployment succeeds when it’s rooted in the community. We foster partnerships between entrepreneurs and local partners—schools, farmers, homeowners, mayors, and workforce providers—to design projects with local context that lead to adoption and lasting impact. Savvy developers know that authentic local partnership derisks early projects for investors.

2,500

local partners–including transit operators, majors, farmers, electricians, community colleges, and labor groups–Elemental companies have worked with to date

HOW WE CONNECT

Investor Mobilization

We unite over 2,000 investors, insurers, financiers, and customers to foster the collaborative ecosystem needed to scale high impact projects successfully. Our portfolio has gone on to raise over $11.5B in follow on capital.

$1.4B

co-investment into Elemental portfolio companies

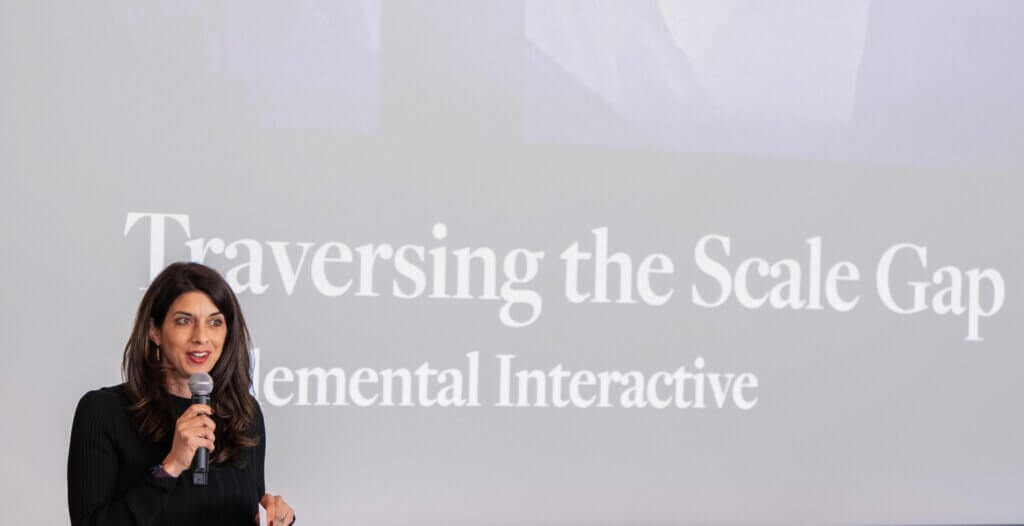

Core to Elemental’s bridge-building is bringing later-stage investors and project financiers closer into the missing middle through unpacking real projects.

Traversing the Scale Gap convening with 100 capital providers—investors, corporates, engineering, procurement, and construction firms (EPCs), and insurers—to meet visionary founders of climate startups.