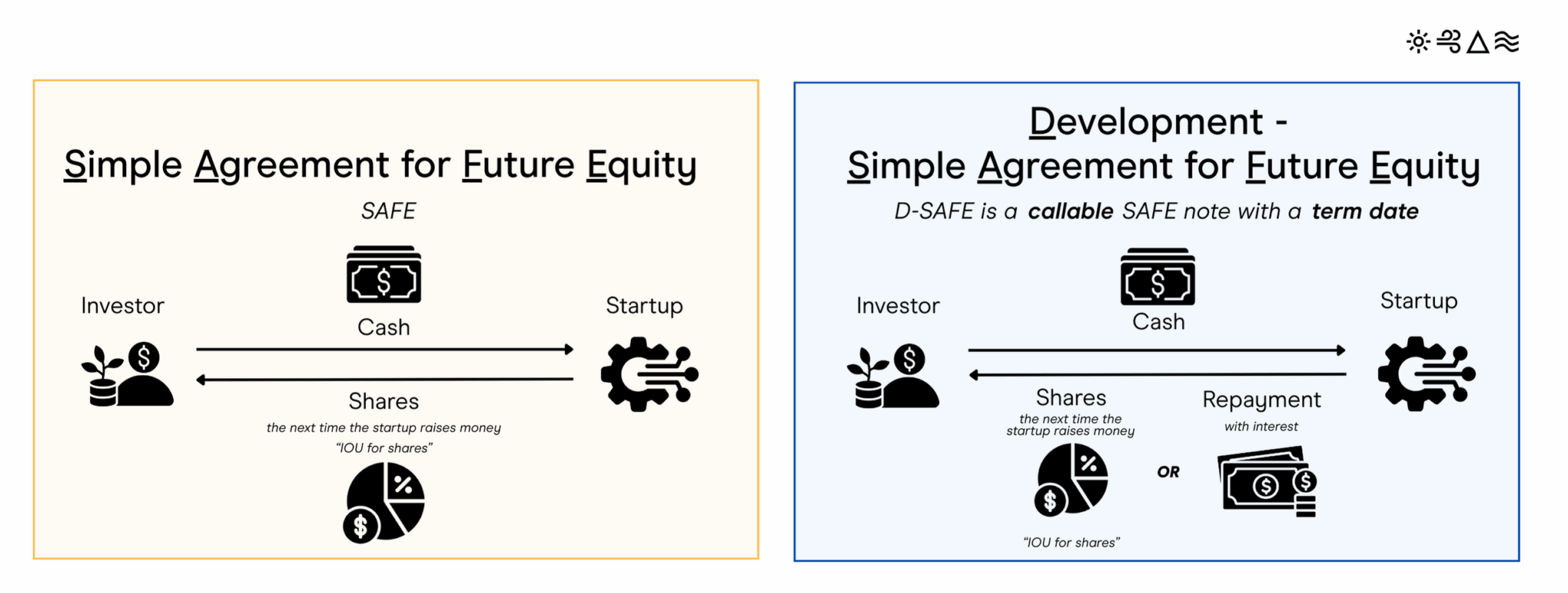

One year ago, we unveiled the Development-SAFE (D-SAFE), a new investment tool to unlock early funding and reduce risk for first-of-a-kind (FOAK) and early commercial projects. Designed in partnership with law firm Wilson Sonsini Goodrich & Rosati (WSGR) and fashioned after the Y-Combinator SAFE, we created the D-SAFE to meet what we perceived as a growing need for financial innovation to bridge the scale gap—a critical investment and expertise shortfall that climate companies face on their path from early-stage projects to widespread commercialization and adoption. Seeing the need for a more flexible financial tool, we built something new.

After tremendous interest from investors, foundations, and startups over the past year, we’re excited to release the templates for broader use, along with a guide on how to customize the instruments per investment.

* Download the Practitioner Notes, D-SAFE and Development Support Agreement (DSA) Templates

___

A year of learning and refinement

Over the past 18 months, Elemental has deployed the D-SAFE and accompanying Development Support Agreement (DSA) across nine investments. It has proven to be a simple, fast, and low-cost way to invest directly in a company—helping move critical projects forward that are essential to advance more resilient energy systems, spur domestic manufacturing, and create local jobs.

Here are three insights from our work:

1. Catalytic capital can make the difference. As a catalytic investor, flexibility, speed, and conviction can play an outsized role in whether a project is financed and built. Elemental’s nearly $7M in collective D-SAFE investments have funded key project development milestones and have already unlocked over $70m private and public sector dollars, a 10x multiple. Here are two examples of this mobilization (plus case studies below):

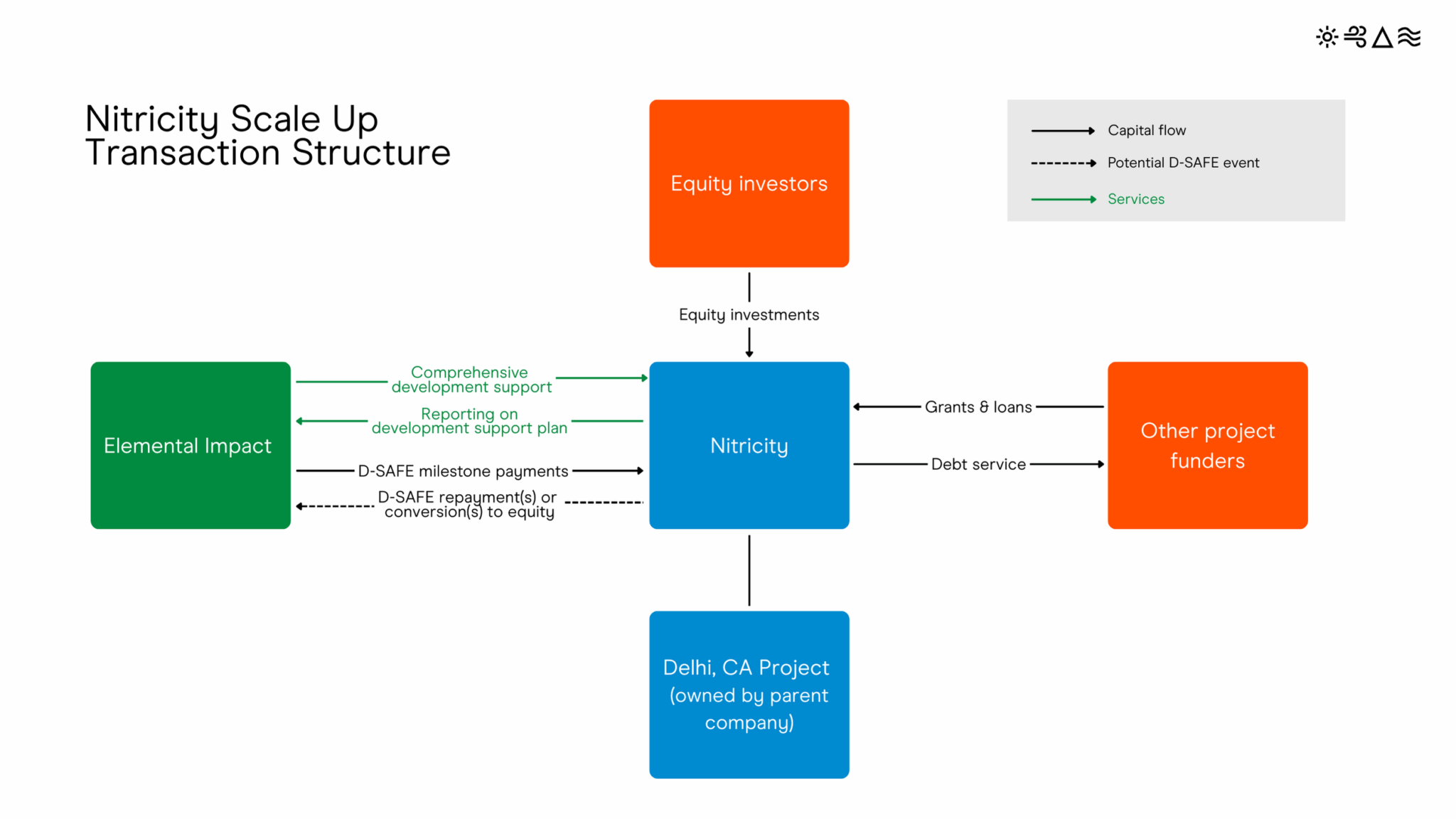

For organic fertilizer company Nitricity, a $2M D-SAFE commitment immediately unlocked $3.6M in development and construction capital from a strategic partner and investor for their FOAK facility—a 100x increase in capacity from their pilot facility. This infusion of capital, in addition to Elemental’s direct investment, represented 44% of the project’s capital stack and helped to pave the way for their Series B led by World Fund.

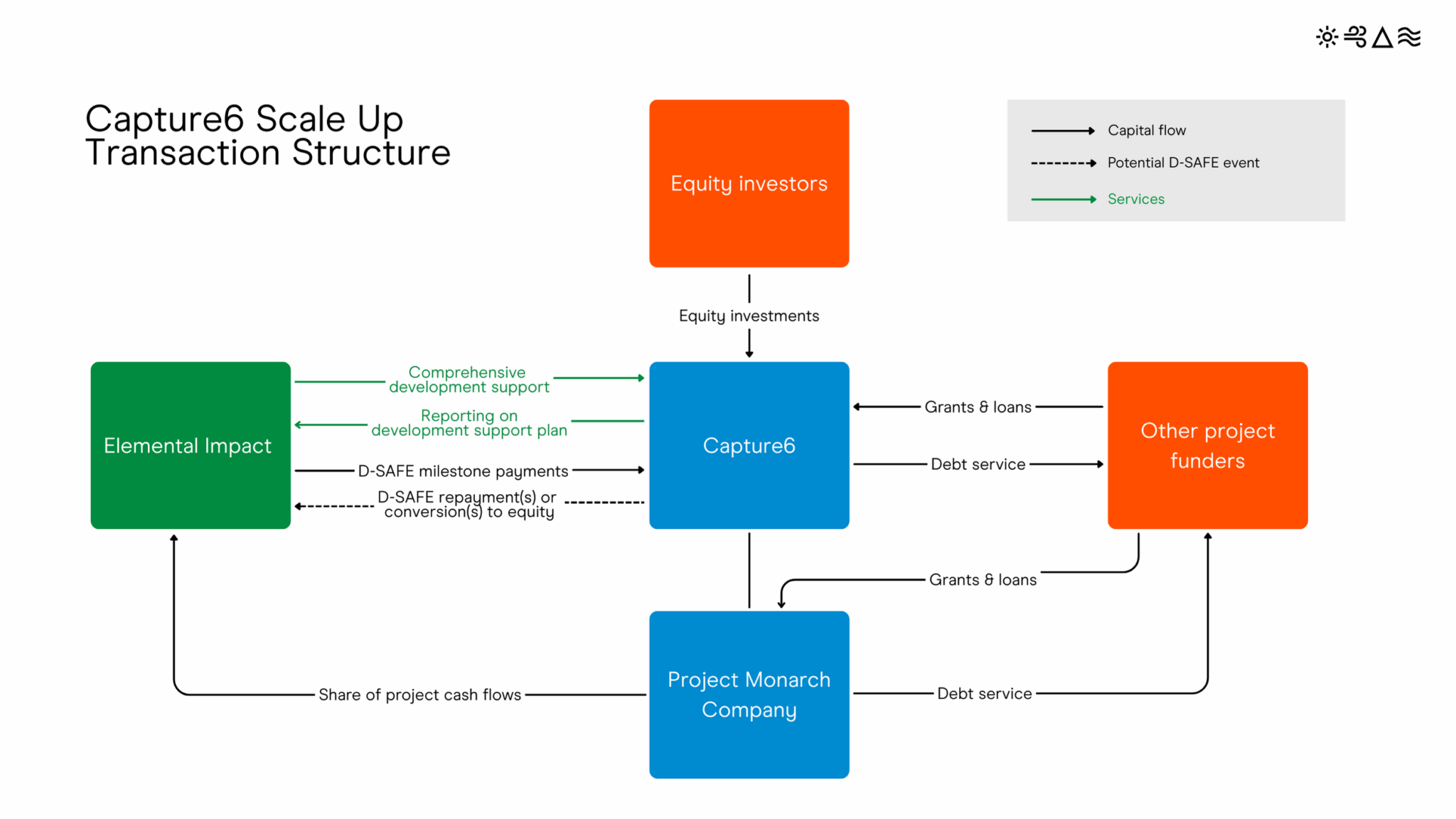

For water and carbon removal company Capture6, our $1.3M D-SAFE and its flexible term structuring helped unlock $13.5M in development and construction capital—from the project partner, local water utility, the California Energy Commission, and other Series A investors—for the first phase of their facility, with a roadmap to unlock another $500M at full scale.

2. The project expertise gap should not be underestimated. Many founders understand that project development is complex and, when it comes time to build, they find themselves in uncharted waters. 71% of Elemental’s portfolio shared that increased internal expertise—including policy and regulatory support—is a critical need for readying projects. That is why we developed the DSA alongside the D-SAFE: it allows us to establish a bespoke support plan for each company, tied to mutually agreed upon funding milestones. By outlining the disbursement of funds at key milestones, the investor and company are aligned early-on on both incentives and outcomes. This allows the investor to commit a larger overall amount without taking on outsized upfront risk. It also gives founders a line of sight into future capital infusions while allowing them to focus on what’s most important: execution.

3. There is no one size fits all. While our nine real-world applications of the D-SAFE and DSA have demonstrated the value and versatility of the tools, project deployment is not a cookie cutter endeavor—and neither is financing it. The instruments are most effective when tailored to match specific project needs, risk profiles, and co-investor requirements. These templates provide a starting point to tailor the terms to each project and company in order to incentivize or actualize incremental repayment (i.e. revenue or equity cash sweeps, or redemption fees and warrant coverage). We have outlined some of those options in the linked Practitioner Note and in footnotes throughout the templates.

* Download the Practitioner Notes, D-SAFE and Development Support Agreement (DSA) Templates

___

The D-SAFE & DSA in action

Nitricity: Fertilizing Agriculture’s Clean Future

Nitricity produces low-emissions organic nitrogen fertilizer using electricity, water, and biomaterial inputs such as almond shells, at centralized locations near farms. For its first commercial-scale facility in Delhi, California—a 100x increase in production capacity from its pilot operation—traditional project finance wasn’t available due to the technology’s novelty and its subscale nature.

Elemental’s $2 million D-SAFE commitment directly catalyzed $3.6 million in additional funding—representing 44% of the total project capital stack. Our milestone-based approach tied funding to concrete achievements such as securing project sites, completing engineering designs, and obtaining regulatory approvals. The DSA framework outlined expectations for Nitricity’s workforce development program, and detailed the comprehensive support that Elemental would provide to help realize workforce partnerships with local colleges and extensive community engagement—from local hiring strategies to community events and fertilizer application trainings.

Perhaps most importantly, the D-SAFE + DSA structure gave Nitricity the operational flexibility to optimize its capital stack, as Elemental could use its first milestone payment to fund certain development costs that other investors were unwilling to finance. As CEO Nico Pinkowski noted: “Elemental’s funding has been fundamentally catalytic to closing the financing for this first-of-a-kind project; it brought everyone together. This FOAK project is prototyping a capital stack, so that now we can hand off from one project to the next.”

Six months later, Nitricity has already repaid the D-SAFE, allowing Elemental to recycle that capital into future projects. Because Elemental chose not to convert the D-SAFE into equity, those shares were reallocated to Nitricity’s Employee Stock Option Plan—giving the company more room to reward and retain top talent. At the same time, because of Elemental’s prior equity investment in Nitricity, Elemental will benefit from the parent company’s progress down the line. And most importantly, the impact—including reduced pollution, resilient fertilizer production, and local jobs—is on track to be realized.

Capture6: Water and Carbon Solutions

Capture6 converts waste brine into fresh, potable water while removing carbon dioxide—addressing two critical environmental challenges simultaneously. Like many industrial startups, Capture6 faces a lack of access to the development and working capital necessary to complete engineering and design work in advance of starting construction, despite having secured construction finance through government and utility partners.

Capture6’s FOAK facility, Project Monarch, in Palmdale, California demonstrates how the D-SAFE can bridge development phases for water infrastructure that meets a key local need while addressing global pollution.

Phase I of Project Monarch will demonstrate technical viability of carbon removal and water recovery. This will unlock Phase II and Phase III, which will scale the facility’s capacity to capture up to 475,000 tons of CO2 a year, while simultaneously recovering over 100 million cubic meters of drinking water. This is approximately equivalent to taking 217,000 cars off the road while providing fresh water for about 30 million households.

Elemental’s D-SAFE provided the development capital needed to complete critical-path design work and navigate complex regulatory requirements. The DSA included provisions to align incentives—by providing a claim to a portion of project-level cash flow, aligning Elemental’s interests with long-term project success. This blended approach helped Capture6 unlock committed, but contingent, construction financing and reimbursable grants from governmental and utility partners, creating a pathway to the eventual $500+ million in follow-on investment needed for the buildout of subsequent project stages.

* Download the Practitioner Notes, D-SAFE and Development Support Agreement (DSA) Templates

___

Elemental Authors and Contributors: Danya Hakeem, Dawn Lippert, Amir Chireh Mehr, Jackson Morton, Aparna Reddy, Mitch Rubin, Gabriel Scheer, and Avra van der Zee.

Special thanks to the contributing team at WSGR: Matt Bogden, Virginia Milner, and Bob O’Connor.