Mission and Impact

Elemental Impact is a 501(c)(3) nonprofit investor focused on scaling innovative technologies with deep environmental and local impact.

Who We Are

Over the past 15+ years, we have invested in first-of-a-kind and early commercial technologies and deployed projects in big cities and small towns.

Today our portfolio includes 160+ companies that are building technologies that make energy more reliable and affordable, help farmers grow food in changing conditions, strengthen domestic supply chains, and create jobs.

Yet, even as venture investment has soared, hundreds of companies that are primed for scale face a critical funding and project expertise shortfall for FOAK and early commercial projects. This is what we call the ‘scale gap,’ and we have designed our approach to helping entrepreneurs traverse it and deliver real impact in communities.

Investing at the Edge of the Market

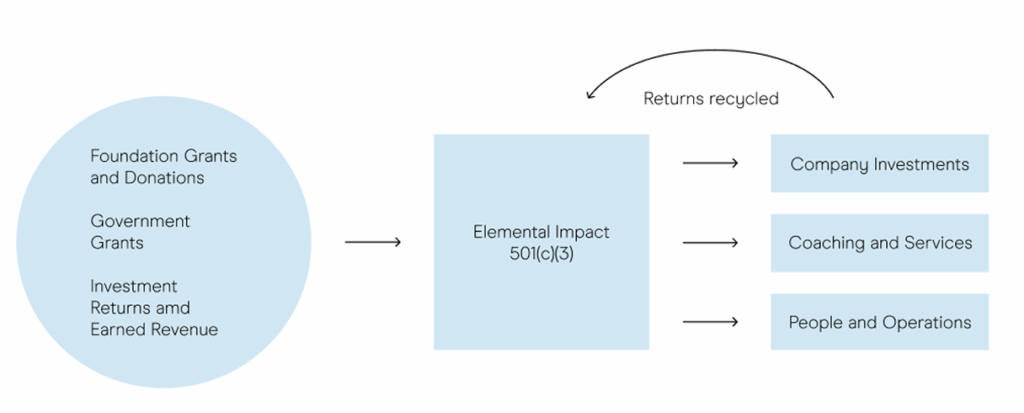

Elemental raises philanthropic and government funding to support our nonprofit model, which enables us to take an impact-first approach to investing.

We are able to support technologies and projects that need patient flexible capital, filling a gap in the market and de-risking those investments for market-rate investors down the line. Our model also enables us to explore and design new investment structures (like the Development SAFE) and recycle any returned capital into our future investments.

As a nonprofit investor, we make investment decisions based on both environmental and local impact—and the potential to attract later stage investment. We take small stakes in our portfolio companies—when they succeed through acquisitions or exits, those returns come back to our 501(c)(3) as earned revenue and are recycled into future projects.

Our Nonprofit Investor Model

Thank You to Our Funders

![]()

Elemental’s work is supported by a vibrant community of visionary foundations, family offices, individual donors, and corporate and government funders. In 2025, we will invite more partners to innovate with us and together, create lasting economic and environmental impact across communities.

Alms Impact Fund of the Tides Foundation

AutoDesk Foundation

Breakthrough Energy Foundation

Cadence Giving Foundation

Chan Zuckerberg Initiative

ClimateWorks Foundation

U.S. Department of Energy

Emerson Collective

The Grantham Foundation for Protection of the Environment

Harold K.L. Castle Foundation

Hindawi Foundation

IN2 Innovation Incubator

JP Morgan Chase & Co

Katsura Fund

The Lemelson Foundation

The Lewis Foundation

LinkedIn

John D. and Catherine T. MacArthur Foundation

Makahakama Foundation

McClain Roberts Foundation

U.S. Office of Naval Research

The David and Lucile Packard Foundation

Salesforce Foundation

Schmidt Family Foundation

Stella Lee Family Charitable Fund

Taketa Ohana Fund 21 of the Hawaii Community Foundation

The Rockefeller Foundation

United Airlines

Waverley St. Foundation

Wells Fargo

WOKA Foundation

15+ Years of Impact

2009

2009

FIRST HAWAII PROJECTS

Dawn Lippert and Maurice Kaya, State of Hawaiʻiʻs Director of Energy, launch early version of accelerator at the Pacific International Center for High Technology Research (PICHTR) seeded by our first government partner: U.S. Department of Energy.

2013

2013

FIRST EQUITY INVESTMENTS

Office of Naval Research awards first multi-year grant. With a new name, Energy Excelerator, we deepened our approach to funding companies and projects, making our first equity investments.

2017

2017

FROM HAWAII TO CALIFORNIA

With our proven community-informed technology deployment model, we grew to become Elemental Excelerator and expanded from Hawaiʻi to California through our philanthropic partner: Emerson Collective. We also diversified our investments from energy to mobility, water, food, and industry.

2019

2019

FROM CALIFORNIA TO GLOBAL

We expanded our investments to global markets. After deploying nearly 100 projects, we identified 1/3 as companies stuck between demonstration and their first-of-a-kind projects—eventually this would be known as the climate technology “missing middle” and Scale Gap.

2021

2021

PUBLISHED 5 YEAR STRATEGY

Elemental outlined our vision for scaling the nonprofit investing platform and impact from 2021 - 2026 through three pillars: Investing in Startup Success, Partnering Deeply and Inspiring Action.

2021

2021

LAUNCHED EARTHSHOT VENTURES

Launched a $94M independent, for-profit venture fund on the Elemental platform, welcoming returns-seeking investors for the first time.

2022

2022

ESTABLISHED POLICY LAB

Elemental formalized our first policy team to help close the gap between federal policy creation and local technology implementation. First Policy Fellows announced.

2023

2023

TRAVERSING THE SCALE GAP

First investor, insurer, EPC, and financier convening for FOAK projects at Climate Week NYC hosted in collaboration with The Rockefeller Foundation. Later published Traversing the Scale Gap and quantified the $150B+ opportunity with Boston Consulting Group.

2023

2023

FIRST DEBT FINANCING

Designed the first Development-SAFE in partnership with WSGR as a financing tool for pre-development costs

Learn more2024

2024

EXPANDED ELEMENTAL PLATFORM

We renamed to Elemental Impact to reflect our expansion from early-stage investments to later-stage deployments. The platform's goal is to catalyze more capital into critical technologies, via multiple funds and investing strategies working in concert.