Aloha friends,

A great navigator (and one of my greatest teachers) taught me that in sailing, there’s the navigator and then there’s the harbor pilot. The navigator can steer the voyaging canoe across the whole ocean and it’s the local harbor pilot who docks the canoe safely among the reefs, rocks and currents.

I love the lesson of the harbor pilot, because at Elemental we deploy projects and pay special attention to last mile implementation. It’s in this last mile where projects succeed … or don’t. We obsess about internet reliability to connect solar on a rural home, regulatory approval for a local food marketplace to accept SNAP-EBT benefits and the availability of electricians to install new electric vehicle chargers.

Momentum, metamorphosis, building.

These are the words our team, now 52 strong, used to describe the past year. In 2023 we implemented more projects with more partners than ever before. We made 37 new and follow-on investments. Over 12 annual cohorts, we have iterated (and iterated) to build an innovation machine for scaling climate technology — while staying rooted in community. You can see the data in our latest Portfolio Insights report, covering portfolio companies working in all 50 states. Of all the numbers we could share from 2023, I want to highlight three:

- $4.7B. This is the financing need for the 300+ projects across energy, transportation, water, food and industry that our Elemental portfolio is ready to build over the next two years.

- 70%. The proportion of projects that will benefit frontline communities.

- 80%. The proportion of projects that need less than $100M to reach the next level of scale. These projects are ready for catalytic capital to bridge to fully commercial or public financing.

This financing need is not limited to the Elemental portfolio. Our recent study with Boston Consulting Group found a $150B financing gap for projects between early-stage VC funding and later-stage growth capital, and the gap is widening. S2G Ventures labeled this gap the “missing middle.” Addressing it is critical to delivering cleaner energy, cleaner water, healthier food and buildings, and access to transportation.

Elemental is focused on scaling companies through the missing middle, and 2024 is shaping up to be a huge year.

I’m going to spend more time laying out our thinking for the coming year than I typically do in this letter. Partly because it’s January, and I recently returned from two weeks of skiing and playing with toy trucks, so I have a ton of energy for what’s ahead. And mostly because the stakes for 2024 are very high, and I don’t want to waste a moment in mobilizing partners who can help get us further faster.

In 2024, Elemental is supercharging our work through three strategies:

1) Mobilizing philanthropic capital to seed the project pipeline.

Together with funders like The Rockefeller Foundation and Waverley Street Foundation, we have begun deploying catalytic capital and customized support. In 2023, we directed over $18M of strategic philanthropy to help bridge companies across the missing middle. Building on more than 14 years of investing, our deals over the last year included funding to catalyze: a $50M sustainable aviation fuel plant in partnership with Seneca Nation in upstate New York, an $18M battery recycling facility in Ohio, a $20M textile manufacturing plant in South Carolina and the next $10M to unlock rooftop solar for affordable housing projects in Georgia, Florida and Mississippi.

Beyond capital, we dig in with companies to make projects investment-ready. This includes anything from placing a project finance expert or fractional CFO, to developing community benefits plans, to helping secure commercial offtake agreements. In 2023, we delivered 900 hours of expert paid coaching, and we will be offering more of these tailored services in 2024.

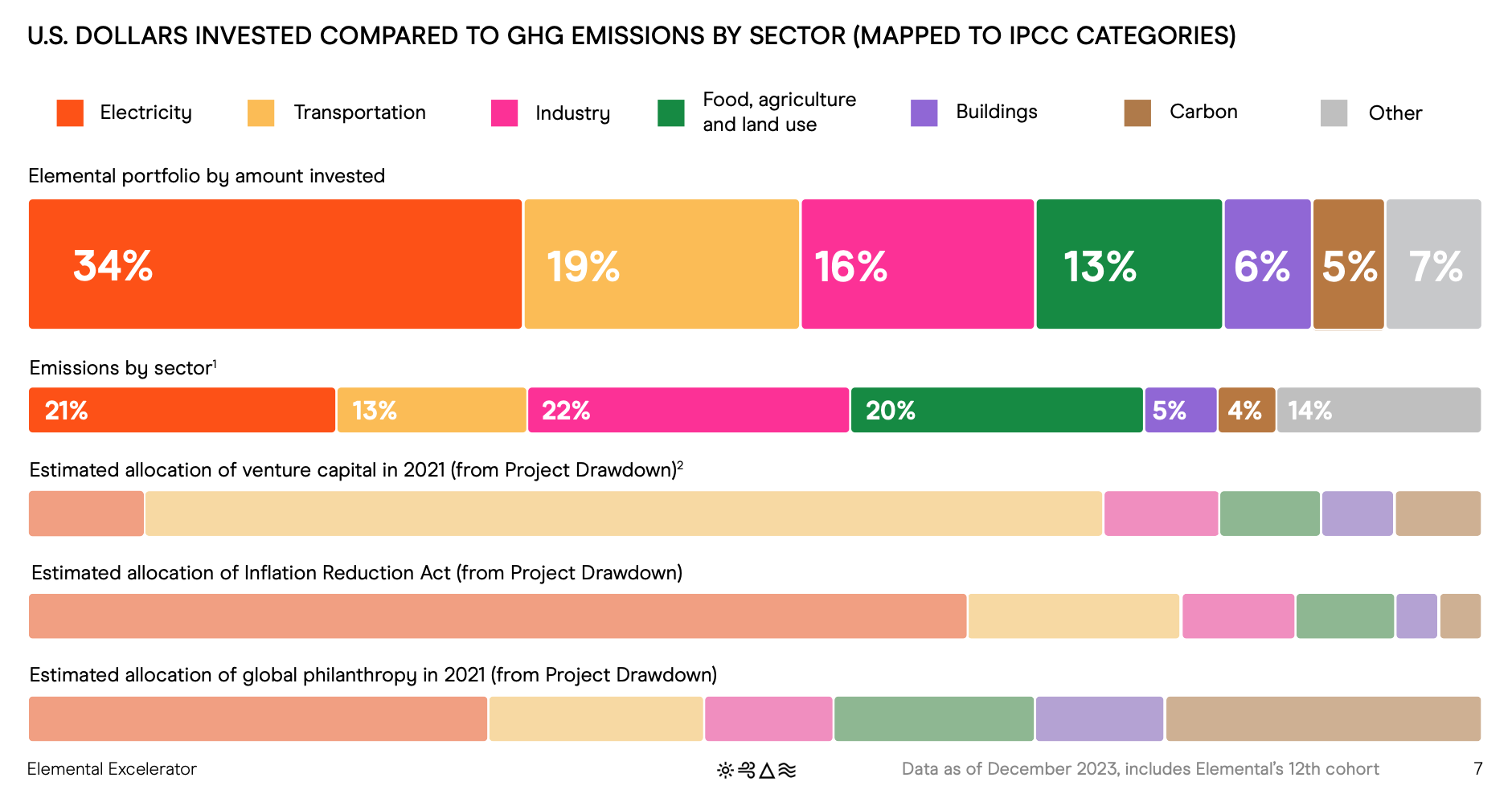

Why are we utilizing philanthropy to seed this pipeline? In our experience, philanthropy allows Elemental to move quickly (we have a vetted pipeline that can be funded as soon as dollars come in), be innovative (we’ve created new financial tools that reduce transaction costs, like the Development SAFE we created with Wilson Sonsini) and invest in the highest impact projects (our investment areas align with the highest emitting sectors — see below). Our nonprofit 501(c)(3) structure enables returns from these investments to be recycled back into Elemental to advance the mission. We have already seen our investments catalyze more than 10x our funding as a result of both financial de-risking and tailored commercialization support — bringing the follow-on funding raised by our portfolio to more than $8B.

We are now ready to ramp up the number and size of catalytic investments. More deployments means more impact.

2) Activating public and private capital to fund projects at scale.

Our entire Elemental program is designed to prepare projects to access government and commercial dollars. Once projects are seeded and de-risked, there is an unprecedented amount of government capital ready to provide tax credits, loan guarantees and other funding. Former White House senior adviser Mitch Landrieu reinforced the urgency at Elemental Interactive: “This is a once in a generation opportunity. That means it hasn’t happened for a long time, and it won’t happen again if we don’t get it right.” One example is the EPA’s $27B Greenhouse Gas Reduction Fund, which we’ve been actively working on. We partnered with multiple coalitions to extend the Fund’s reach beyond solar and electric vehicle chargers to also include more categories of innovation. This Fund will be capitalizing hundreds of green banks and CDFIs (community development financial institutions), and we are so energized to co-invest alongside them.

Co-investing is a natural role for us. This year we found out that Elemental is the second most highly networked climate investor, coming in only behind the National Science Foundation (see below). We’ve collaborated with over 1,000 public and private funders, 530 deal flow partners and 270 project partners. One friend called us “the Kevin Bacon of climate funding.” This is by design; last year we hosted and collaborated on events that brought together more than 1,600 investors and industry leaders in Alabama, California, DC, Florida, Georgia, Massachusetts, Michigan, New York, Ohio … as well as in Dubai and around the world.

Climate Finance Tracker mapped investors by number of co-investors and equity/justice mentions.

3) Amplifying impact for real people and real communities.

Storytelling is a powerful tool for impact. This is about the renter in Florida saving $110 on his monthly electric bill, the former oil worker now drilling for clean geothermal energy, the mayor of Long Beach talking to other mayors about how to electrify trucking at major ports and even Colin Jost using humor to celebrate young talent in climate. Good stories can create demand for climate solutions at the local level. It is imperative that we collectively lean into this more now than ever.

Catalyze, stay proximate, high stakes.

These are some of our team’s theme words for the next 12 months. This year, the stakes feel higher than ever. We will vote in a landmark national election, determine how the commitments of COP28 unfold and support the rollout of the most significant climate legislation in U.S. history — the Inflation Reduction Act. We are so well positioned to make this the year of last mile implementation in a way that is high impact, relevant and inspiring.

Thank you to every one of you who has been part of our journey. We can do so much more together than we can do alone.

With gratitude,

Dawn Lippert, Founder & CEO, Elemental Excelerator and Founding Partner, Earthshot Ventures