At Elemental, we’re often innovating to fill gaps to scale climate technology and have deep community impact. One gap that we’ve been increasingly focusing on is what we call the “Scale Gap.” Once climate technology companies pass the R&D phase and build a successful pilot, commercializing their solutions at scale requires an entirely different set of skills. There are a variety of factors that include founder knowledge, technology risk and development risk that give rise to the Scale Gap. These multiple dimensions of risk require fit-for-purpose capital with the capacity and mandate to fund companies that sit within the Scale Gap1.

At Elemental, we’ve been thinking about this gap for several years. We developed the Commercial Inflection Point scale as a step to address climate tech’s Scale Gap and publicly shared it in March 2022, covered by our friends at CTVC.

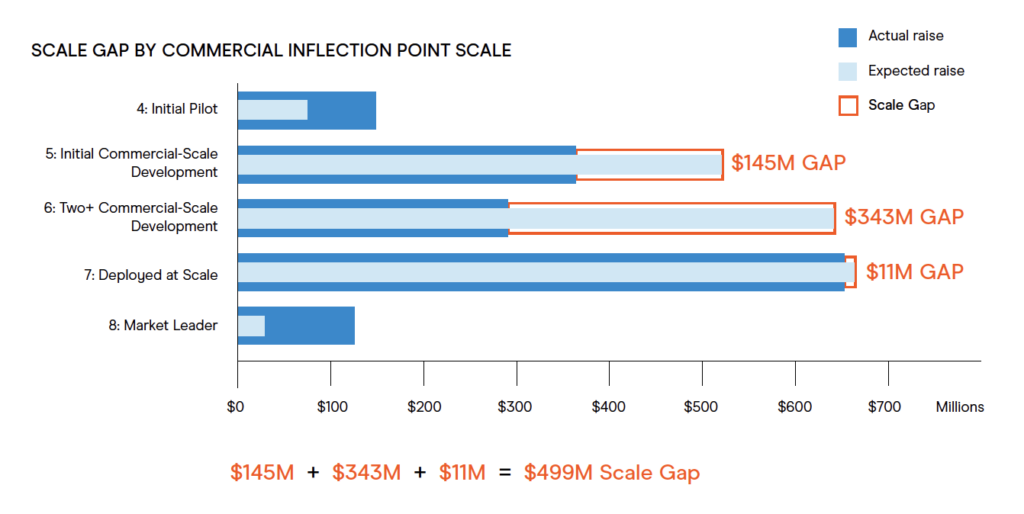

Over the past year, we have been laser focused on Commercial Inflection Points 5-7 (i.e., between the initial commercial-scale deployment to two or more commercial-scale deployments to being deployed at scale). We dug deeper with many of our founders to understand their needs and quantify the Scale Gap they are experiencing.

In 2022, we surveyed our portfolio companies about what they raised alongside what they planned to raise, and found that access to capital is not evenly distributed across all stages. At early stages, significant capital is available. It’s the later stages of growth — as companies are deploying their first, second and tenth projects — where we see a Scale Gap of ~$500M.

And most of this gap is projects whose funding needs range from just ~$5M-100M2. These are neither “asset-light” (typically software) or “asset-heavy” (typically $1B+); we call these asset-medium and they’ll make up at least 40% of the emissions reduction needed.

Considering the ~3,0003 climate tech startups in the U.S. that either are at or are approaching Commercial Inflection Point 5, the Scale Gap could amount to more than ~$150B-250B4 in just the U.S.

So, now that we have an elegant way to objectively talk about the different stages in the commercialization journey and have assessed the size of the problem for our portfolio, what are we doing about it? Since March, we have been funding companies in the Scale Gap to draw in new co-investors and speed up our learning cycle; we have funded eight projects so far and will share more about them soon. And since July, we have been partnering with Boston Consulting Group (BCG), and last month at Climate Week NYC, alongside The Rockefeller Foundation, we hosted a growing community from across climate finance to address the major gap between what venture capital will fund and what larger infrastructure investors won’t.

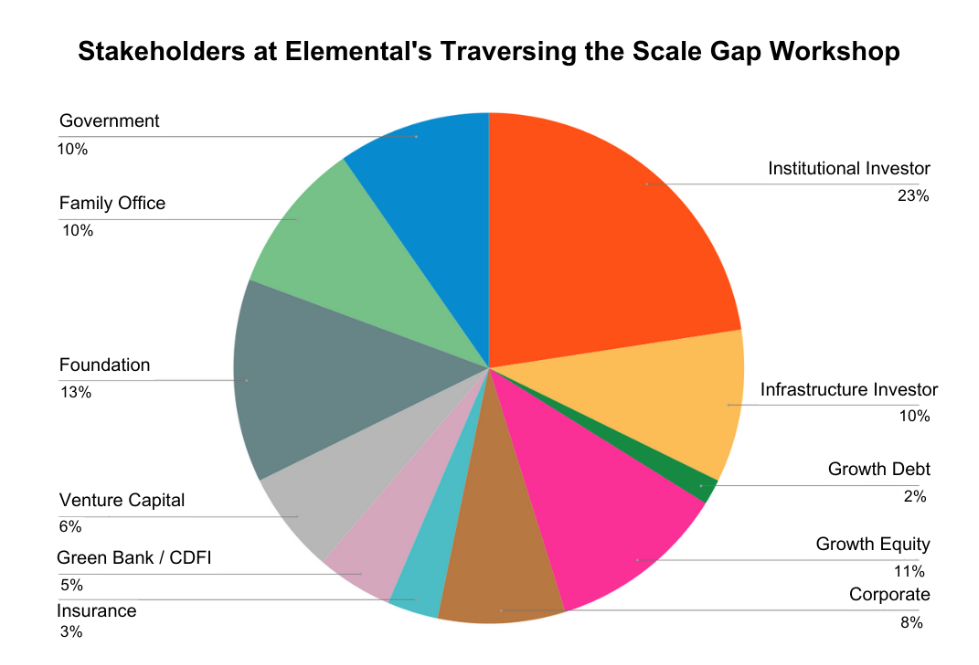

In a morning convening, we invited five companies to workshop live deals in this gap. We gathered 105 leaders from family offices, foundations, green banks, corporates, engineering firms, insurance companies, venture funds, growth equity funds, and infrastructure and institutional investors to figure out, in real time, how to collaborate to finance them. Through working on the Scale Gap — rather than just talking about it — we revealed some helpful insights.

While it wasn’t lost on anyone in the room what a significant challenge it is to traverse the Scale Gap, what resonated across investors was that financing breakthrough technology doesn’t require breakthrough funding models; rather, we can close the gap with “old tools” and “new friends.”

The theme of “old tools” and “new friends” framed some simple, yet powerful, invitations to different actors:

- Corporates: The elevated role of corporates, as strategic friends, who can reduce project and market risks by providing capital, corporate assets (e.g., project development knowledge; engineering expertise; go-to-market channels), and potentially serve as offtakers. As one investor put it, “Strategic corporates need to come in more and not just provide finance at critical mid-growth stages, but also provide relevant project development expertise and opportunities for offtakes.”

- Engineering, Procurement and Construction Companies (EPCs): We need alternative players to join the effort and help derisk projects (from development to execution to market risks) — particularly EPCs. As one growth equity investor put it, “EPCs have the most important and hardest job: executing the project. And they can pull various levers to help derisk projects — from wrapped contracts to deferred payment structures.” To reduce the costs of engaging a big EPC, investors suggested tools such as warrants or earn-outs to create the right incentive alignment.

- Insurers: What was particularly interesting was that attendees were most keen to see insurance providers play a central role in helping derisk investments. Insurers can lean in with performance guarantees, offtake insurance, credit enhancement, tax-credit insurance and other tools.

- Limited Partners (LPs): While there are some fantastic platforms that are experimenting with investing in this space, we need more funds capitalized with a mandate to deploy here. As one GP put it, “We asset managers can only do what our clients allow us to do. The risk budget that we’re given is determined by the LP base.”

- Specialized General Partners (GPs): LPs have limited risk tolerance for investing in this class given the unpredictability of cash flows and high risk profile, which is why we need GP platforms with scientific, engineering and policy talent to effectively evaluate and underwrite risk in this space, as well as generate portfolio value.

- Philanthropy: Many projects within the Scale Gap have investment profiles that won’t meet market-rate internal rate of return (IRR) hurdles. This is where philanthropy, government and other sources of capital can be truly catalytic and “additional.” We heard insights about how philanthropy can structure capital into innovative platforms, concessionary vehicles and public-private partnerships that have the mandate to fill this gap. A decade ago, it was clear that very early R&D needed philanthropic capital to fill the technology pipeline, and now this later-stage gap has emerged as just as (or even more) critical to meeting climate and community benefit objectives.

These observations come from over 50 interviews and conversations with active investors across the capital stack. Many of our friends in the space have been talking about this same gap, too. In 2021, Prime Coalition highlighted the need for common terminology and definitions, particularly around first-of-a-kind (FOAK) projects. The Department of Energy released their Adoption Readiness Scale to better address the challenges of deployment. CTVC published a series of fantastic articles to educate the ecosystem on “the bridge to bankability.” And most recently, s2g released a piece showing how new funds are further exacerbating “the missing middle.” We are grateful that all four and many others have been thinking deeply about this gap as well — traversing the Scale Gap is truly a team effort.

We’re well underway building bridges across many groups of “new friends” who each bring creative approaches, different tools and dedicated capital that unlocks climate progress.

If you’d like to collaborate with us, please reach out!

Special thanks to Parham Peiroo and Fiona Tokple and the rest of the BCG case team for their partnership and contributions to this post.

——————————————

1 There is another Scale Gap, which is the expansion of commercialized technologies into low-income communities where the issue is not so much technology risk, but rather perceived credit risk.

2 Elemental Excelerator, 2023; Extantia Capital, 2023 (Source).

3 Pitchbook, 2023; ~3,000 companies are at or nearing Series B.

4 Pitchbook, 2023; For the ~3,000 companies who are at or nearing Series B, we assume they have an average deal size of $50M-$80M (average Series B and C deal size), totaling $150B-$240B capital required. The capital need may be larger given that these figures account for topco investment and do not imply project-level investment.