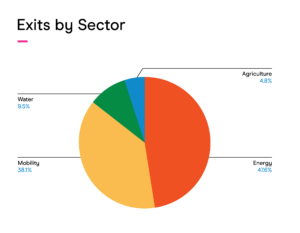

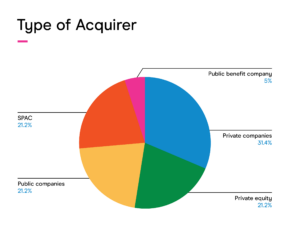

Just six months in, 2021 has already been the most active year for portfolio company success in the history of Elemental. We recently celebrated our 20th exit, which means out of our portfolio of 117 companies, roughly 1 in 6 have gone public or been acquired.

If you had predicted at the beginning of the COVID-19 pandemic that our portfolio and the climate movement would come out stronger than ever, it would have been hard to imagine. Building a climate-tech company is very, very difficult work. Our entrepreneurs are commercializing technologies that unstick calcified systems, redesign some of humanity’s largest machines, and challenge some of our most powerful industries. Throughout the pandemic and a tumultuous 2020, everything around us was changing in unpredictable ways — our social norms, work environments, schools, and buying behavior.

But here we are over a year later. It has been difficult for everyone but miraculously, climate tech has come out stronger, in stark contrast to a merciless year for the oil & gas industry. We’re seeing more funding enter the space, including a record $17B+ of venture funding poured into climate-tech startups with big ideas. The unique and challenging conditions created by the pandemic also revealed surprising growth opportunities for many of our portfolio companies — whether it be FREDsense adapting its water-sensing technology to test for COVID, Numina’s computer vision tool illustrating new patterns of movement in urban spaces, or Farm Link Hawaii experiencing exponential growth to meet the demand for locally grown and delivered food.

We are amazed by the grit, determination, and ingenuity that we have witnessed across our portfolio not just over the past year, but since we began funding climate-tech companies in 2009. While startup exits are just one metric of success among many others in our line of work, a quick trip down memory lane shows that the pace of change and opportunities for growth in the climate sector are intensifying. While we aren’t able to share all the details due to confidentiality or transactions still underway, here is a quick celebration of the stories that are public in chronological order.

This post continues below this information.

In putting together this post, we struggled with how to account for our exits and report them out to the world. Some were financially positive and returned funding to Elemental, which we reinvest to build our organization, fund future entrepreneurs, and support STEM career pathways to provide job opportunities for the diverse and talented people who want to be part of the climate solution movement.

We also debated the impact of these acquisitions. Some accessed the public markets to infuse capital to fuel huge growth. Others chose the acquisition path to help their technology scale through the parent company’s established channels, or adapt its use-case to have more urgent benefit to the climate. Still others were not growing quickly enough to fulfill their ambitions, and made the decision to partner with an organization that could integrate their technology and expertise into a different product or offering. So, as an impact-driven investor and social change organization, we decided to count them all as positive impact and learning. When we bring our companies together in Hawai’i in February 2022 for our CEO & Leadership Summit, which we host annually along with virtual gatherings throughout the year, it’s often the toughest stories that generate the most insight for others — and collectively move our sector forward.

It’s about the journey, as Megan Rapinoe reminds us on the eve of the Olympics, “If you miss a shot, you missed it. You can’t go back. You can only try to not make the same mistake twice. I’ve won a lot in my career, and I’ve lost a lot. You take the good with the bad. Also, it’s not only about winning. It’s about the process and the journey, the people you’re with, continuing to grow and learn, and getting better every day.”

Please join us in celebrating these company builders and teams for their dedication and hard work.

It sets the stage — there will be many more big stories and successes to come.

What other insights would you like Elemental to share? What would help you move faster? Send us some ideas here.