Back in 2011, Breakthrough Institute published a report articulating something that investors and entrepreneurs long knew: startups in essential industries such as energy, water, agriculture, and mobility face more hurdles on the way to success than other types of tech companies. In addition to crossing a valley of death when getting ready to raise their first round, these companies face many more scaling challenges than a typical software startup.

Elemental Impact has developed a framework for understanding how climate technology companies actually grow and what it means to succeed at each stage—the Commercial Inflection Point Scale.

The climate tech gap

In 2009, when Elemental launched our mission to scale innovative technologies with deep environmental and local impact, our team identified a funding gap for deploying technologies after the initial launch. Early stage venture capital and government research funding helped to launch new companies, and later stage venture capital and growth equity helped them scale once the technology and business model were proven. What happens in the space between those two often makes all the difference between a successful growth trajectory and a company that doesn’t survive.

More times than not, our portfolio companies experience a fundamental, game-changing evolution after their first deployment.

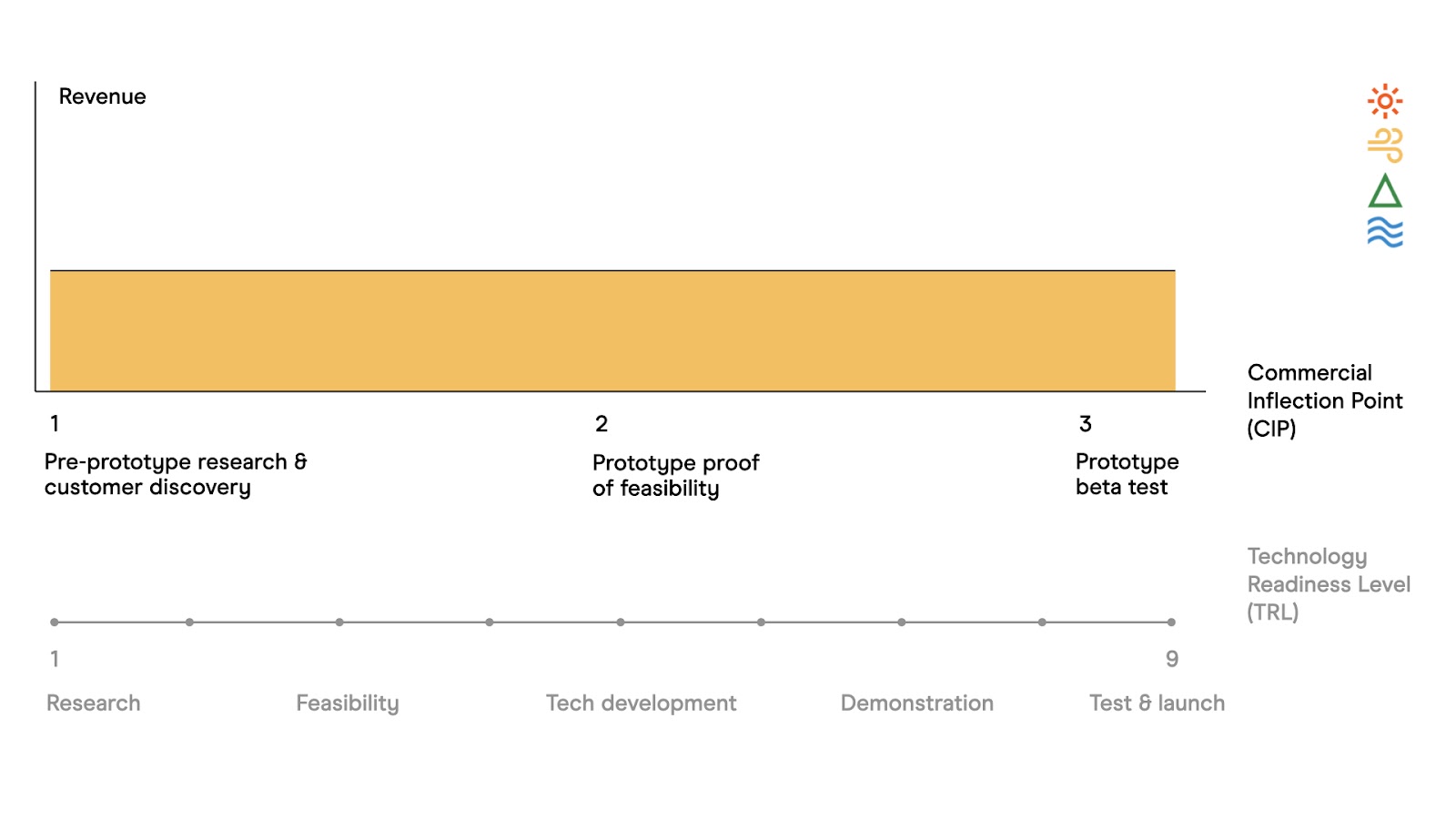

The scales most typically used in our space, such as Technology Readiness Level (TRL)—which was developed by NASA in the 1970s to determine how mature any given technology is—are used by organizations far and wide, well beyond the U.S. government. However, scales like TRL often stop at “market introduction” or “launch.”

But the launch of a product is actually only the end of the technology development cycle, and just the beginning of the commercialization journey. A major funding and expertise gap begins at TRL 9, or what we call Commercial Inflection Point 4.

This is when the really difficult work begins: deploying technology with customers in the real world. The path to scale often requires significant capital, involves numerous strategic and local partners, and calls for thoughtful, complex, and iterative deployments. What a company learns from its initial deployments informs its future trajectory, and integrating these insights into its business model and go-to-market strategy is critical for success. More times than not, our portfolio companies experience a fundamental, game-changing evolution after their first deployment.

Commercial Inflection Point (CIP) Scale

Our novel Commercial Inflection Point (CIP) scale captures the major milestones from ideation to mass market adoption.

By expanding the traditional measuring stick for company growth, the CIP scale 1) helps entrepreneurs navigate commercialization, and 2) helps investors successfully invest before, through, and after the commercialization gap in funding. This extended scale, capturing something closer to the true journey of a climate startup, gives entrepreneurs and investors a common language that helps unlock funding and accelerate impact.

The CIP scale is a blend of commercial and technical milestones and is applicable for hardware and software companies. A downloadable version of the Commercial Inflection Point Scale is available here.

Some Transformative Projects

A large part of Elemental’s support is directed to scale-up projects, which captures the iterative nature of learning through deployments. These can be first in-the-ground or in-the-cloud—or they may be when a company expands to:

🌍 A new geography

⚡️ A new business model

🧩 A new customer segment

💡 A new product offering

🤝 A new community, or with a new local partner

Here are a few examples of how this has played out with our portfolio companies on the ground:

🧩 Customer: Vence provides an animal management platform for livestock farmers that enables regenerative agriculture.

Vence joined Elemental at CIP 4, with a number of smaller-scale pilots across the US. The Elemental project was their first demonstration with an enterprise customer. It successfully validated the commercial readiness of the second iteration of the technology and helped them scale into a new geography: Australia. Following the project, Vence was at a CIP 6, with dozens of commercial customers across the US and Australia and has since been acquired by Merck.

💡 Product: Ampaire is developing scalable electric powertrains for aircraft.

When Ampaire joined Elemental at CIP 4, they had demonstrated the company’s Electric EEL airplane — an upgraded six-seat Cessna 337 technology — in small-scale trials. Through the Elemental project, Ampaire became the first to fly a hybrid aircraft on an actual commercial airline route in partnership with Mokulele Airlines. Mokulele is a subsidiary of Southern Airways, one of the largest commuter airlines in the U.S. Following the project, Ampaire, shifted to CIP 5, successfully completed multiple first flights with new generations of their system, refined and scaled their technology and supply chain, and has begun to integrate into much larger aircrafts.

🤝 Local Partnership: Remix is the software platform for shaping urban mobility.

When they joined Elemental at CIP 7, they were already used by 4,000 planners in 325+ cities on three continents. However, as their customer base grew from transit agencies to city departments of transportation, they saw a need for more “impact insights” on the platform. Through Elemental, Remix partnered with a group of transportation advocates assembled by Oakland-based mobility non-profit, TransForm, to develop a software tool to more quickly discover and understand demographic and income data. To follow, Remix scaled to CIP 8 and was acquired by Via shortly after completing the project.

How do we fill the gap? Philanthropy builds a bridge.

The gap identified for first-of-a-kind projects between commercial inflection points 4 and 7, still persists. Far too often, companies get stuck raising expensive dilutive venture capital to deploy their first pilots, diluting potential returns and creating suboptimal incentives. Most growth-stage capital providers require multiple commercial proof points from startups.

The good news is that there are more vehicles that have emerged to finance and support startups through this gap—such as Elemental’s D-SAFE, Breakthrough Catalyst, and LACI Market Transformation. These are largely powered by philanthropic dollars, and the vehicles are specifically designed to enable companies to scale to the point that debt vehicles and other capital can get in the game.

Why Does This Matter?

Scale drives impact. In order for these technologies to contribute to environmental and economic impact, they need to get to first, second, and third commercial-scale deployments and deployment at scale. Ultimately, they need to become market leaders.

And in order to bridge the gap, we need hundreds of philanthropists, banks, and structured programs to help serve as the bridge from initial technology development to commercialization at scale. The faster that entrepreneurs who are building technologies that solve the world’s most pressing challenges—making energy more reliable and affordable, helping farmers grow food in changing conditions, strengthening U.S. supply chains—can get through the commercialization inflection points, and become leaders in their markets, the more impact they will deliver. And that’s something we all want to see.